David

David Patrick has traded bond futures,spreads,equities and options for over 20 years. He graduated from The Ohio State University with a degree in Finance, in 1995. He started his business career as a Trust Tax Accountant for National City Bank. He became an Investment Advisor at Olde Discount Stockbrokers in 1998. Five years later he became a top trader for Elite Trading LLC. At this hedge fund, David led a team of traders specializing in bond future spreads to an impeccable track record. In 2008 he branched out on his own and became a very successful Independent Trader. On January 25th, 2013 he successfully launched Fitzstock Charts Premium Service. This elite trading service has helped traders around the world learn his proprietary trading methodology.

David,

You consistently say trade price and don’t worry about volume, but IBD is focused on volume as a key indicator. I am conflicted on that point. Can you please expound on why it doesn’t matter. I dont have the personality of a day trader as I cant pull the trigger fast enough, I believe I am more swing trader oriented. Thanks in advance for your thoughtful response. Thanks, John

David,

Is pivot bands the same theory as ” pivot points” that are used on most charting software?

Thanks, Mark

John,

I never said volume does not matter. I do not use it with my methodology, as PRICE is the only thing that pays. The whole rally this year had no volume, so if you were in that camp……you just missed one of the biggest bull runs in a while. Trade price, ignore noise(swing or day trading)

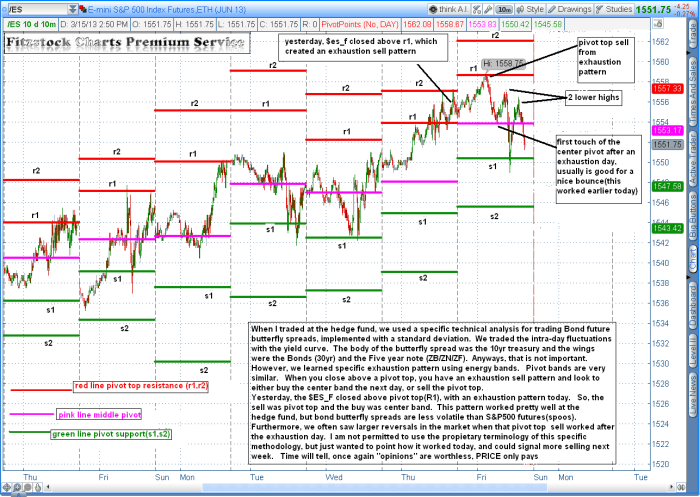

Yes. Pivot points are used on TOS(charts) also

Hi, do these pivot points learnings apply also to individual stocks, i.e. AAPL? Should we expect similar behaviour from big liquid stocks? thanks!

No,

I do not trade pivot points with equities.