There are many different types of traders who are subscribing to Fitzstock Charts Premium Service. Some people are aggressive and looking for quick short term setups, with defined risk. Others are more conservative and want to “buy and hold” for weeks or months. I have designed the service with calculated entries and defined risk to meet the needs of all traders. My suggested entries on CWUS and the Daily updates can be used for day trading or swing trading opportunities. Unfortunately, I can not predict the market and will not know which trades end up being great swing trades, or just day trade scalps. I do a little of both with my trading account. I like to take the quick setups and reduce my risk by scalping out of my position at +5% (1/2 my position) and +10%(another 1/4) and then let my runners(the last 1/4) run for me. Sometimes these runners get stopped out , as I raise my stops. Other times I add to my runners and they pay me even more (I did this with GOOG twice). I do this to manage my risk, and then let my winners keep rewarding me. As I have stated many times, you will have losing trades –so riding your winners is essential.

My short term trading style is not for everyone. If you are taking positions swing long(or short), you will not be scaling quick and leaving runners. Swing traders try to enter a position with good risk/reward and less transactions and monitoring. This type of trading is very efficient also, but you need to have your timing right. When the markets are extended for periods of time(like we are seeing now), it is very frustrating to swing long traders who are not involved. When this happens, you need to be patient and wait. If you missed an opportunity, NEVER CHASE a stock. There will be plenty of swing opportunities over the next 10 months. Unfortunately, I will not be able to predict when the market corrects. When we see a pullback from the highs and find support at a higher moving average(50sma) you will have a better risk/reward setup to go swing long.

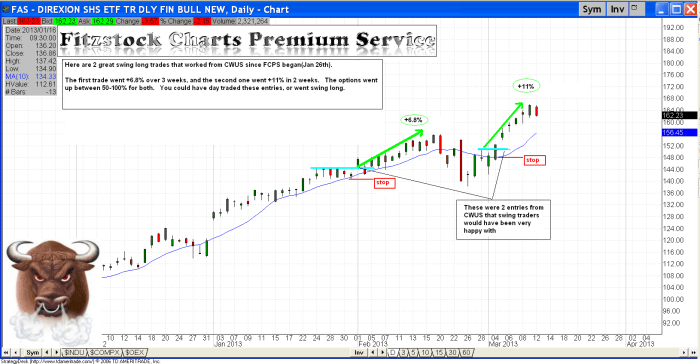

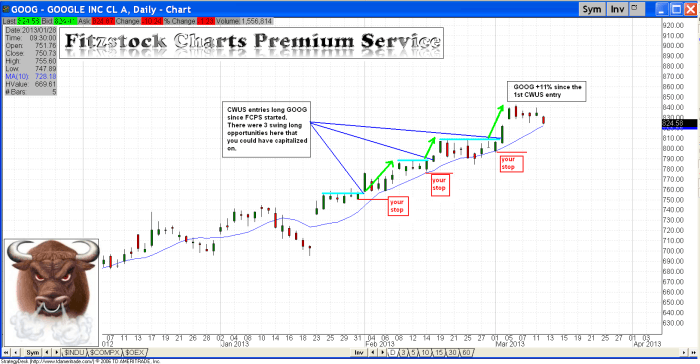

I have attached 2 charts (FAS and GOOG) that were great swing long opportunities since FCPS started. There have been many swing and day trading opportunities over the last 6 weeks. The attached charts show the CWUS entries and your potential if you held your winning positions. If you are a swing long trader, you should trade long verse a specific level(i.e-10sma or 50sma) or a Fib % retracement (which I will post). Do not get frustrated if you missed some trades, there will be plenty of opportunities. I have said a million times, the market moves in waves. If you are a swing traders you need PATIENCE.

Swing Trader

- looks for longer term trade opportunities lasting weeks or months

- often buys zones rather than a specific price

- trades with stops at a Fib% retracement , a simple moving average(10, 20 or 50)

- is not interesting in capitalizing on smaller price movements in the market

- usually does not have the time to micro manage his/her positions

- seeks opportunities with defined risk and larger reward

- looks at daily and weekly charts to find specific price patterns to capitalize on

Day trader

- tries to capitalize on small price fluctuations in the market

- uses very tight stops(lows of the day) and is quick to book profits

- looks at daily and intra-day charts to find specific price pattern to capitalize on

- is an aggressive trader and has time to monitor and manage intra-day fluctuations of his/her positions

Fitzstock Charts now has over 1,000 different stock options that have DOUBLED from our suggested entries, while some options have returned over 600%

We are educating traders around the world with our Rules of Engagement (ROE) based on market trend. If you are under performing the stock market with your trades and investments, it is never too late to upgrade.

https://www.youtube.com/watch?v=-yH6PKJa6tU

What does Fitzstock Charts include?

-Daily email updates include our Focus List with calculated entries and defined risk

-Stock chart technical analysis searching for relative strength and weakness

-Weekly video analysis covering our Focus List and the current market conditions

-Educational videos and posts using our trading methodology (ROE)

-Access to private Twitter (@fitzstockcharts) where I post real time updates and trades

Follow me on social media:

Twitter (public): https://twitter.com/Fitzstock2004

Facebook: https://www.facebook.com/fitzstockcharts/

Linkedin: https://www.linkedin.com/in/david-patrick-a0411110a/

YouTube: https://www.youtube.com/watch?v=-yH6PKJa6tU

Learn stock trading with specific stock chart patterns and how to day trade stocks with Fitzstock Charts. We scan for historical chart pattern comparisons with trading rules of engagements. The #1 Stock trading consultant in the business, teaching you how to get started trading. Learn how to read stock charts with our key essentials to trading success. We find the best stock charts and implement stock options trading strategies with stock chart technical analysis. If you want learn more stock chart analysis and chart patterns we trade, check out my daily blog updates.

Blog: https://fitzstock.com/how-to-get-started-trading-how-to-day-trade/

We are constantly scanning for the best stocks to buy, best stock to trade, and tell you how to trade stock options.

Fitzstock top links:

Charts: https://fitzstock.com/historical-chart-pattern-comparisons-how-to-read-stock-charts/

Consultations: https://fitzstock.com/stock-trading-consultants-stock-charts-technical-analysis/

Performance: https://fitzstock.com/key-essentials-to-trading-success-stock-options-trading-strategies/

Testimonials: https://fitzstock.com/trading-rules-of-engagement-learn-stock-trading/

I look forward to helping you meet all your investment and trading goals.

David Patrick

Fitzstock Charts, LLC

Stock trading consultants, historical chart pattern comparisons, key essentials to trading success, trading rules of engagement, learn stock trading, how to read stock charts, stock chart technical analysis, how to day trade stocks, how to get started trading, best stock charts, stock chart analysis, stock options trading, stocks to buy now, how to trade stocks,best stocks to buy, how to trade stock options, technical analysis charts, stock trading charts, stock trading service, stock market update, how to trade options, stock trading charts, stock chart analysis, chart patterns, stock chart patterns, stock market technical analysis.