How to read stock charts?

Whether you are a beginner or veteran trader you need to keep things simple while reading the charts. There are hundreds of different indicators and market timing devices.

Here are some of the top trading tools

-Moving averages

-Stochastics

-Bollinger Bands

– McClellan Oscl.

-Ichimoku

-Money flow

-Pivot points

-VWAP

-Volume

-Candlestick patterns

-Elliot wave

-Fibonacci

-NYMO

-Accum/Distr

-RSI

-Money Flow

And hundreds more!

We keep things simple by trading Rules of Engagement (ROE) based on market trend. Most of you are looking at candle charts, while I focus on bar charts. It is easier for me to see opening prices and close prices using simple daily bar charts. Many of you use weighted moving average for your moving averages. I use “simple” moving averages to keep thing simple. Moving averages are a tool most active traders use to measure momentum. The primary difference between a simple moving average, weighted moving average, and exponential moving average is the formula used to create the average. For a simple moving average, the formula is the sum of the data points over a given period divided by the number of periods. Weighted moving average assigns a heavier weighting to more current data points since they are more relevant than data points in the distant past. The weighted moving average is calculated by multiplying the given price by its associated weighting and totaling the values. Also, many use Exponential moving averages to read the charts. Exponential moving averages are also weighted toward the most recent prices, but the rate of decrease between one price and its preceding price is not consistent. I don’t like to get to caught up in all these definitions, but rather what works. The simple moving average works best using ROE, with Historical Chart Pattern Comparisons (HCPC). Our next simple way to read the charts is using a momentum indicator called Moving Average Convergence Divergence (MACD). Quite simply this indicator needs to head in the same direction of price and the market trend, to engage in a new stock trade. Many traders want to see a MACD bull cross, or “above the zero line”, but we keep things simple. Lastly, we use price pattern which repeats itself over time with psychology and emotions of the stock market. We scan thousands of charts searching for price pattern repetition we call Historical Chart Pattern Comparisons (HCPC). Some of the price patterns we trade are WV/MA/head and shoulder, bull/bear flag , break of trendlines. We have over 900 stock options that have doubled using this simple trading methodology of ROE with HCPC. You can use ROE on any time frame, as many active subscribers are now using 5 -minute charts to day trade . The most important thing with trading is risk management. Always define your risk before every trade. Fitzstock Charts identifies the trend, scans the charts searching for pattern repetitions, and then implements ROE using calculated entries with defined risk. All new trade setups are listed on our daily Engagement Spreadsheet Focus List (ESFL). Trading is NOT easy, but we have a clear cut trading edge using Rules of Engagement.

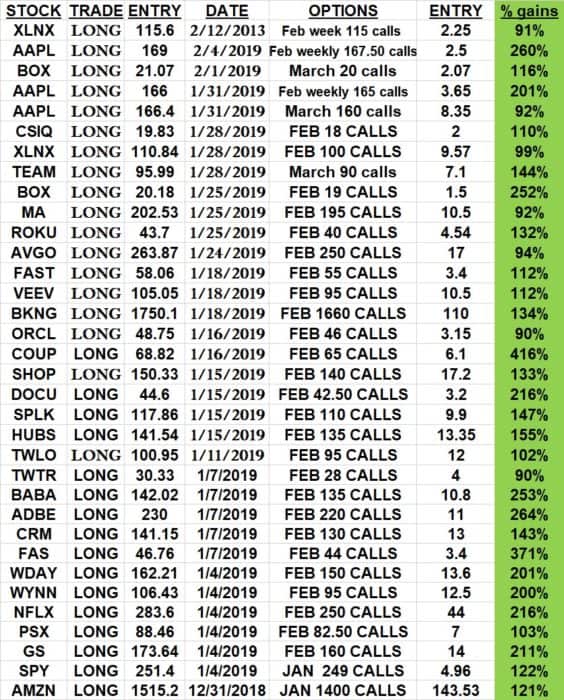

Here are the top performing trades in 2019 using ROE with HCPC

Fitzstock Charts now has over 1,000 different stock options that have DOUBLED from our suggested entries, while some options have returned over 600%

We are educating traders around the world with our Rules of Engagement (ROE) based on market trend. If you are under performing the stock market with your trades and investments, it is never too late to upgrade.

What does Fitzstock Charts include?

-Daily email updates include our Focus List with calculated entries and defined risk

-Stock chart technical analysis searching for relative strength and weakness

-Weekly video analysis covering our Focus List and the current market conditions

-Educational videos and posts using our trading methodology (ROE)

-Access to private Twitter (@fitzstockcharts) where I post real time updates and trades

Follow me on social media:

Twitter (public): https://twitter.com/Fitzstock2004

Facebook: https://www.facebook.com/fitzstockcharts/

Linkedin: https://www.linkedin.com/in/david-patrick-a0411110a/

YouTube: https://www.youtube.com/watch?v=-yH6PKJa6tU

Learn stock trading and how to day trade with Fitzstock Charts. We scan for historical chart pattern comparisons with trading rules of engagements. The #1 Stock trading consultant in the business, teaching you how to get started trading. Learn how to read stock charts with our key essentials to trading success. We find the best stock charts and implement stock options trading strategies with stock chart technical analysis. If you want learn more stock chart analysis, check out my daily blog updates. We are constantly scanning for the best stocks to buy, best stock to trade, and tell you how to trade stock options.

https://fitzstock.com/how-to-get-started-trading-how-to-day-trade/

Fitzstock website links:

Charts: https://fitzstock.com/historical-chart-pattern-comparisons-how-to-read-stock-charts/

Consultations: https://fitzstock.com/stock-trading-consultants-stock-charts-technical-analysis/

Performance: https://fitzstock.com/key-essentials-to-trading-success-stock-options-trading-strategies/

Testimonials:https://fitzstock.com/trading-rules-of-engagement-learn-stock-trading/

Affiliates: http://www.qantminvestors.com

I look forward to helping you meet all your investment and trading goals.

David Patrick

Fitzstock Charts, LLC

Stock trading consultants, historical chart pattern comparisons, key essentials to trading success, trading rules of engagement, learn stock trading, how to read stock charts, stock chart technical analysis, how to day trade stocks, how to get started trading, best stock charts, stock chart analysis, stock options trading strategies, how to trade stock options, best stocks to trade, best stocks to buy.

————————————————————————–

Blog bottom

If you are under performing the stock market with your trades and investments, it is never too late to upgrade to Fitzstock Charts https://fitzstock.com/

Follow me on social media:

Twitter: https://twitter.com/Fitzstock2004

Facebook: https://www.facebook.com/fitzstockcharts/

Linkedin: https://www.linkedin.com/in/david-patrick-a0411110a/

I look forward to helping you meet all your investment and trading goals.

David Patrick

Fitzstock Charts

About me: https://fitzstock.com/stock-chart-analysis-best-stock-charts/

Stock trading consultants, historical chart pattern comparisons, key essentials to trading success, trading rules of engagement, learn stock trading, how to read stock charts, stock chart technical analysis, how to day trade stocks, how to get started trading, best stock charts, stock chart analysis, stock options trading strategies, how to trade stock options, best stocks to trade, best stocks to buy, stocks to buy now, stocks to watch, how to trade stocks, how to trade stock options, technical analysis charts, stock trading charts