We have seen some HUGE profits over the last 4 months of the service and I would like to take some time to address a few things.

Risk management is the most important “essential” to long term trading success.

There are 3 forms of Risk Management

1) Placing PHYSICAL STOPS (not mental stops) on all trades.

No exceptions to this rule.

2) Scaling profits at pre-calculated areas to reduce overall risk (and eventually have no risk …aka-“free runner”)

3) Trade Size Allocation. (you do not need big size to make a lot of money……Do not allocate >5% of your trading account to any trade idea until you have consistent profits in your account. Once you have significant profits, you can raise the bar some, as you are risking the house’s money (Do not exceed >10% on any trade, even if you have huge gains in your trading account)

I have discussed these 3 forms of Risk Management to many of you in the 1 on 1 Trader Consultations.

However, I want to focus more on “scaling profits” today.

So, why do we scale?

Scaling means booking profits and specified (calculated) areas to reward your trade and reduce your risk.

Do day traders, hybrid and swing traders all scale in the same spots?

There are no “set in stone” rules for who should scale where. However, it is very important that all traders use some sort of scaling method in their trading plan.

I call myself a “hybrid trader” as I am not a true day trader (who is flat all positions by end of trading day), or swing trader (who is looking to trade longer term, muli-weeks). I often use the previous day’s low as my stop and like to carry very little risk overnight (only runners, or hedge positions)

Some of my rules (as hybrid) are as follows:

1% initial scale

I scale ½ my profits when the stock has gone +1% (i.e. GOOG going from 900 to 909) . This will be an approximate move in the option of +10%, with the strikes we are using. At this point the trade has worked and all traders should be scaling a portion of their position (to reduce risk). I generally will leave my initial stop where it was.

2% rule-(scale and raise stop to breakeven)

My next scale is at +2% in the stock which is approx +20% in the options. At this point I scale another ¼ of my trade and raise my stop to my entry cost to assure a winner does not turn into a loser. This also allows me to ride a huge winning trade higher, rather then raising my stop.

So, if I had 100 GOOG calls, I would be holding 25 with very little risk.

From this point it is the trader’s discretion on how to manage this remainder of their position (as every traders risk profile and trading time horizon is different)

Some traders will scale another 5-10% to keep the remainder of the trade risk free ,“free runner” (only risking profits)

100% rule-(scale down to 10% runner, then roll to higher strike)

When my options trade have gone +100%, I reduce my runner to 10% of the initial trade, and I roll to the next month with more aggressive options (i.e. – 1% ITM or even At-the- Money options). Since I am only risking profits, I am very aggressive with the remaining position. Swing traders might be more conservative and just roll to the next month with 3% ITM calls or even use a call spread (3% ITM long and sell 5% OTM against)

So, if I (hybrid) had 100 GOOG calls on from 3% ITM (.70 Delta) and am only holding 10 of them, I will roll to next months 1% ITM (or ATM) increasing the number of contracts but not the risk.

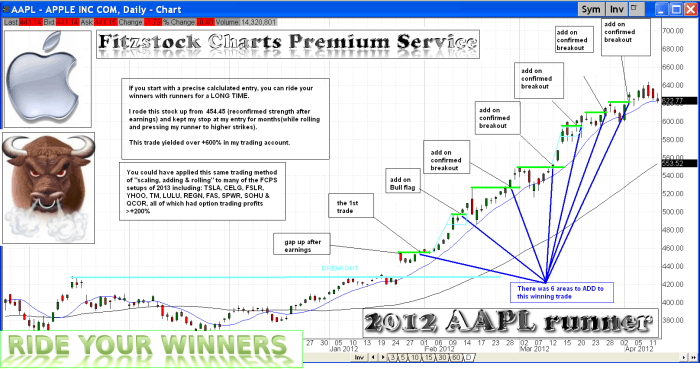

I have attached a copy of AAPL chart from last year (Jan-June), where I was able to make +600% in my trading account using this method. It all started from a day trade, that turned into a runner, then “free runner”, and then “roll & press” (to higher strikes)

Once again, this method can be modified to meet your trading style and may not be suitable for all traders. You need to evaluate every trade and make sure it meets your risk profile and trading time horizon.

Using this trading technique with just a few of the 2013 FCPS setups like: TSLA, CELG, FSLR, YHOO, TM, LULU, REGN, FAS, SPWR, SOHU, & QCOR (which all had profits>+200% in options) you would be smiling from ear to ear.

David Patrick

Fitzstock Charts, LLC